The best solutions on the market of artificial intelligence stock trading software for starters and for investors with less capital it is often better to start with a ready made trading service so that they can taste the waters and deep dive in the essentials of artificial intelligence stock trading software solutions.

Best open source algorithmic trading software.

No charges to open and maintain an account.

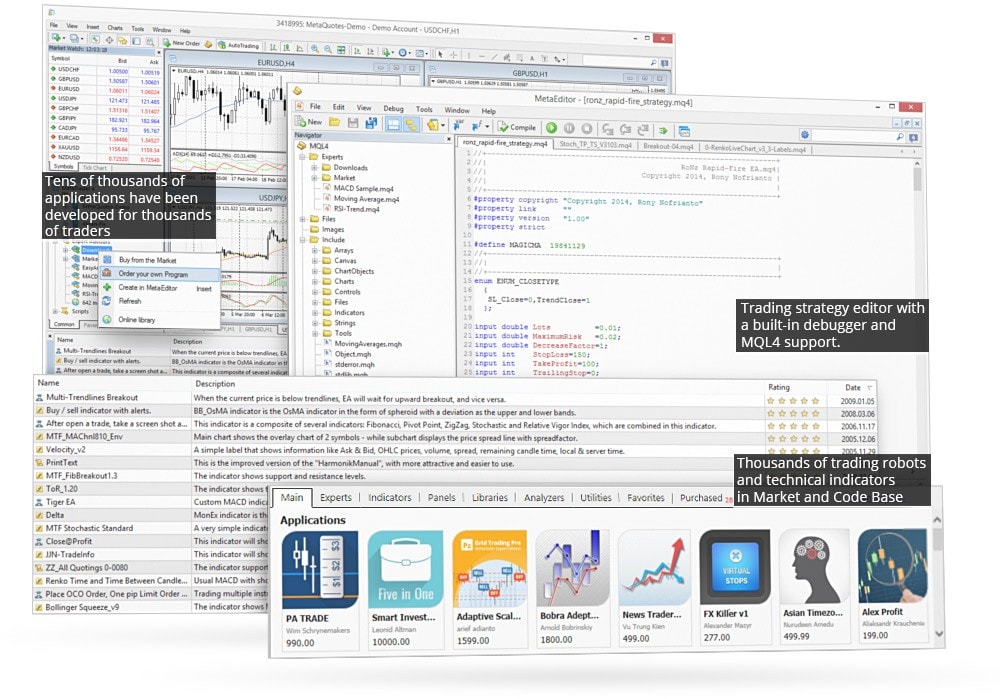

The algorithm development environment includes really handy collaboration tools and an open source debugger.

No account maintenance fees or software platform fees.

However one potential source of reliable information is from lucas liew creator of the online algorithmic trading course algotrading101.

Algorithmic robots capable of.

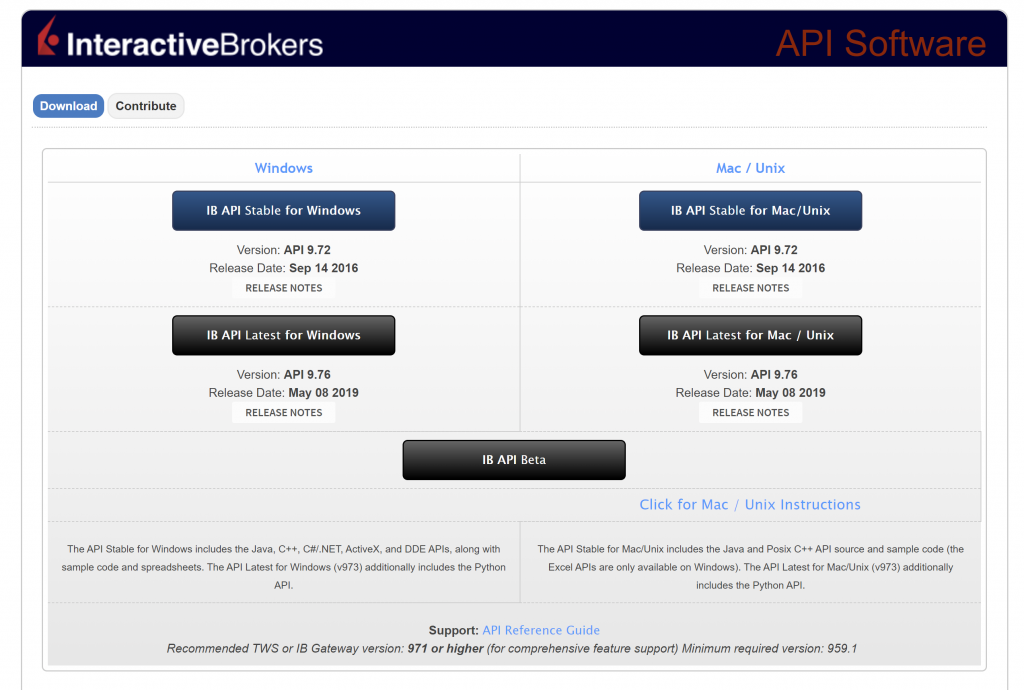

Picking the correct software is essential in developing an algorithmic trading system.

Like quantopian tradingview allows users to share their results and visualizations with others in the community and receive feedback.

Wrapper library for algorithmic trading in python 3 providing dma stp access to darwinex liquidity via a zeromq enabled metatrader bridge ea.

A trading algorithm is a step by step set of instructions that will guide buy and sell orders.

The best automated trading software makes this possible.

Paperbroker 153 an open source simulated options brokerage and ui for paper trading algorithmic interfaces and backtesting.

As of august 2020 the course has garnered over 33 000.

Quantopian s platform is built around python and includes all the open source goodness that that the python community has to offer pandas numpy scikitlearn.

But one area more than any has taken the investing sphere by storm and that is the world of copy trading and social trading where people who want to grow their money choose to follow the winners of the world and place their trust in quality traders or ai based algorithmic software solutions with proven histories of positive roi.

Tradingview is a visualization tool with a vibrant open source community.

Founded in 2011 quantconnect offers an open source algorithmic trading platform providing over 90 000 quants with access to financial data cloud computing and a coding environment to design algorithms.

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)